Government Business Loans

Government Business Loans

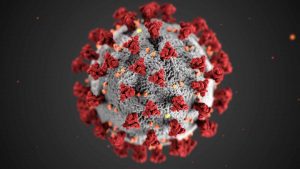

It’s no secret that the world is in a tricky position right now. Businesses across the globe are having to close their doors in the wake of Covid-19. They are not finding the support they need to continue operating. The economy is going to take a hit from this outbreak, especially seasonal industries, construction, and retail.

The government is currently taking unprecedented action to be able to solve this problem. Of course, due to the nature of this issue, it’s not possible for the government to provide every bit of support to businesses on an automated basis. Instead, for some of the financial support on offer, you need to go out and manually apply.

The Support On Offer on businesses during Covid-19

As mentioned above, the government has done an excellent job of offering assistants to companies during the lockdown. Some of this comes to you automatically, and these are the first entries on the list below. For loans, grants, and employee wage support, you will need to go out of your way to get help, and this is where Pinnacle Business Finance comes in.

Deferred VAT & Self-Assessment Payments

VAT payments can end up being massive when you’re not prepared for them. The government recognizes that many companies simply haven’t had time to prepare for Covid-19. For this reason, those that are due to pay VAT between 20 March 2020 and 30 June 2020 have the option to have this payment deferred to a later date. You need to contact HMRC to take advantage of this.

Self-assessment payments can also be deferred until January 2021, although you will have to continue your regular payments during 2020. Similar to VAT, you can talk to HMRC to receive support on this.

Statutory Sick Pay Relief

Companies still need to be prepared to honour the contracts they have with their employees while Covid-19 is unprecedented. To help with this, the government is offering up to 2 weeks of statutory sick pay relief. This is for businesses with less than 250 employees. Furthermore, new regulations have been introduced to cover employees being paid SSP from day 1 instead of day 4 with it being retrospectively applied from the 13th of March 2020.

12-Month Business Rate Holiday

Shops and other public-facing businesses have to pay astronomical business rates. To support companies to get through this challenging time, a 12-month business rate holiday has been put into place. This is to make sure that companies aren’t overwhelmed by the costs. You don’t need to do anything to get support like this, but your local authorities may have to send you a new bill to reflect these changes.

Grant Funding Up To £25k

For retail, leisure, and hospitality businesses, the government is offering grant funding of up to £25k during the Covid-19 outbreak. This is to cover a variety of different things. You need to apply for the scheme through your local authority. Your business needs to have a rateable value of £51k or less to be able to receive this sort of funding.

For businesses that don’t pay business rates, a one-time grant of £10k may be available. You can access this in the same way as the £25k grant, and it should be a smooth process as long as your accounting is up to date. If you need a recommendation on an accountant, give Pinnacle a call and we have trusted accountants who we work with.

Coronavirus Business Interruption Loan Scheme- Business Loan

The Coronavirus Business Interruption Loan Scheme has been designed to apply to as many different businesses as possible, whether they’re big, small, or somewhere in the middle. The scheme prominently supports SMEs with access to loans up to £5 million over 6 years.

The government is also able to make payments towards interest and loan set up fees for the first 12 months. This ensures that smaller businesses won’t struggle with the initial outlay cost of setting up the commercial loan.

Here at Pinnacle, we’re already working with the 40 accredited lenders the government has chosen for this scheme. This means that we can give you the support you need as soon as possible. Whilst making it much easier to get started with the process. If you don’t qualify for the commercial loan don’t panic! We have a range of alternative lenders who can support.

Coronavirus Job Retention Scheme

The Coronavirus Job Retention Scheme is the most popular and well-known part of this package. This is designed to avoid the fallout of millions of people losing their jobs at the same time. Giving employers the methods to pay their employees even if they are unable to keep their doors open.

The furlough will cover up to 80% of someone’s pay, but this stops once it reaches £2.5k per month. Along with this, the scheme will also cover national insurance payments and pension contributions, ensuring that people don’t fall behind in these areas.

Coronavirus Job Retention Scheme or Furlough is open to all employers which started a PAYE payroll scheme as late as February 28th, 2020. It has to be the employer applying for it, rather than the employee themselves.

How Can Pinnacle Business Finance Help your businesses during Covid-19?

Pinnacle is a well-placed finance broker in Bristol, that provides access to commercial finance across the UK at this challenging time. We’ve moved our team to work from home, but productivity is still strong, and we’re working as hard as we can to help companies across the South West to keep themselves afloat.

We can secure grants and loans being offered by the government and are happy to take all of the work which will come with this off of your shoulders. That’s one of our many jobs as a commercial finance broker. You tell our funding specialists what you need, and we go out and secure the commercial finance for you.

Alongside helping businesses to get the grants and loans they need, we can also support you through the other schemes being offered by the government at the moment. This can be as little as having a phone call to discuss your options. To assess larger projects such as cash-flow forecasting through these challenging times. You can use the form below to get in contact or give us a call on 0117 2510048 to chat with our dedicated team.

Government Business Loans

Government Business Loans